The country's biggest paper merchant Ball & Doggett has officially launched, with the name for the merged entity of BJ Ball and KW Doggett now decided.

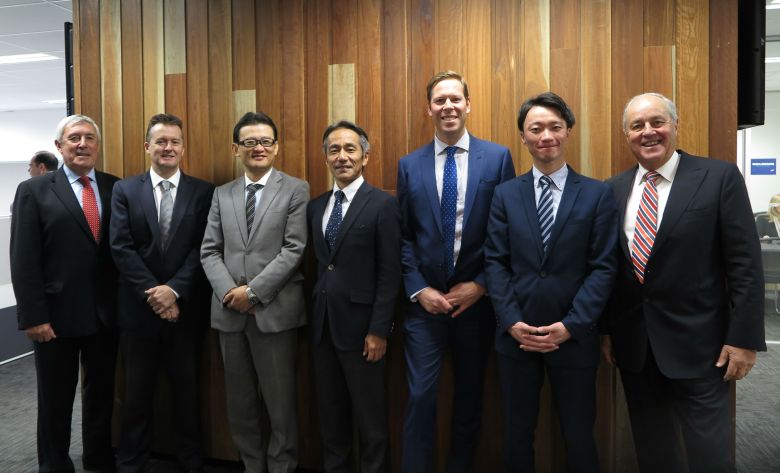

Executives from Japan Paper & Pulp (JP) visited the BJ Ball factory in Dandenong, Melbourne to launch the newly merged company, with Australian Printer given exclusive access.

Shota Arai, Australian director, JP; Mitsutoshi Imamura, senior vice president and general manager, Corporate Planning Division, JP; and Masaaki Sato, general manager International Sales, JP were present.

Australia’s newest, biggest paper merchant combines industry giants BJ Ball and KW Doggett, and is owned by JP, which has a 51 per cent share, with an option to buy the remaining 49 per cent in two years time.

BJ Ball was formerly owned by a private equity fund, whuile KW Doggett has been family owned since its inception in the 1970s. Former BJ Ball chief Craig Bown will be CEO of the new business, with Simon Dogget as the new managing director.

JP has big plans in paper, here and overseas, and is seeking to become the world’s number one paper distributor.

Imamura says, “We strongly believe this purchase fits perfectly into our international strategy. Our presence in Australia and New Zealand has been quite limited and we have been seeking an opportunity to enter the market for a long time.

“In our medium term business plan, we are aiming to become the world`s number one paper distributor and we trust this purchase will accelerate our plans to achieve this target. It will also allow us to be more active globally. We believe the Oceania business legacy and platform of Ball & Doggett is perfect and that JP’s networks shall bring a tremendous synergy.”

The decision to include an option for the remaining 49 per cent of shares to be bought in two years is a reflection of how long JP believes the integration process will take.

Imamura explains, “After the new entity starts operation, the integration and restructure of five key areas in Australia will be led by the current management team. We estimate it will take approximately one to two years, so the acquisition of the remaining shares will take place after all the restructure and integration is complete."

Australian Printer also spoke to Craig Brown and Simon Doggett about the merger, and how it felt to be working with a former rival.

Doggett says, “It was a bit strange the first few times we met. As you say, we have been competing against each other for years. After the first few meetings we realised they have good people with great experience and technical know-how, as do we. And most importantly, we share a common vision for our industry. We have always had a healthy respect for the BJ Ball team and felt they have been very progressive with their business in recent years.

“We have been following with envy their market leading i-consignment model as the growth of digital printing continued to impact our traditional business model. We also admired the acquisitions they had undertaken in recent years to fast track the diversity within their business into growth categories such as roll label, wide format and other substrates.”

Brown notes that “KW Doggett Fine Paper has been a strong performing business, well led and with a great culture that we at BJ Ball can identify with. It is good to see that our values are aligned and we have strengths in different areas that will work well together as a new entity.”

As Ball & Doggett now has the resources of JP behind it, the company says it will pass on added value to customers, with priority number one being maintaining the same levels of customer service.

“It is too early to provide comment on the impact of JP and its global resources on Ball & Doggett. However, the paper and print supply chain continues to be under constant cost pressures and we believe we can help combat this by creating a more efficient supply chain solution.

“This could include technology solutions along with volume leverage with our larger buying power. Ultimately, this will deliver value to Australian customers either via price or efficiency solutions. Rest assured, as we find value we will look to pass this down to our customers as this will be our competitive advantage.

“We respect that we are on notice from our customers as we bring Ball & Doggett to life. We cannot afford to be complacent or let our customers down. It is up to us to prove to our customers that this merger will deliver value to the industry."

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter