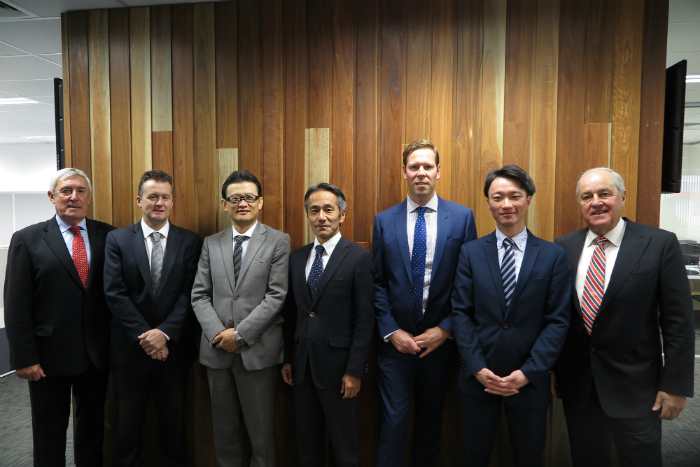

Newly merged paper merchants BJ Ball and KW Doggett have unveiled its new name, Ball & Doggett, with new owner Japan Pulp and Paper (JP) hosting the official launch.

The two merchants are now 51 per cent owned by JP, and now the merger is complete says it will focus on maintaining its high service levels to its customer base.

JP has the option to buy the remaining 49 per cent of the business sin two years’ time, by which point the harmonisation of the two businesses will be fully realised.

Simon Doggett, previously managing director of KW Doggett is now managing director of Ball & Doggett with Craig Brown former head of BJ Ball the new CEO.

[Related: ACCC gives green light KW Doggett and BJ Ball merger]

Doggett says, “We have always had a healthy respect for the BJ Ball team and felt they have been very progressive with their business in recent years. We have been following with envy their market leading i-consignment model as the growth of digital printing continued to impact our traditional business model.

“We also admired the acquisitions they had undertaken in recent years to fast track the diversity within their business into growth categories such as roll label, wide format and other substrates.”

Ball & Doggett says it is the now largest, most diversified paper, packaging and print media distribution business across Australia and New Zealand, delivering broader product offerings and improved supply chain efficiencies. At the end of May the ACCC approved the merger with JP to own 51 per cent of the merged group for an investment of $75m.

The company says that after the new entity starts operation, the integration and restructure of five key areas in Australia will be led by the current management team. It estimates it will take approximately 1 to 2 years, so the acquisition of the remaining shares will take place after all the restructure and integration is complete.

Mitsutoshi Imamura, senior vice president and general manager, Japan Pulp and Paper says the purchase of BJ Ball and KW Doggett fits into the company’s international strategy.

“Our presence in Australia and New Zealand has been quite limited and we have been seeking an opportunity to enter the market for a long time. In our medium term business plan, we are aiming to become the world`s number one paper distributor and we trust this purchase will accelerate our plans to achieve this target. It will also allow us to be more active globally. We believe the Oceania business legacy and platform of Ball & Doggett is perfect and that JP’s networks shall bring a tremendous synergy.”

“Although discussions to purchase BJ Ball started a few years ago, it was not possible to build up a good strategy to ensure a stronger market position. However, thanks to the combination of BJ Ball and KW Doggett Fine Paper, we are now very confident we can create more value for all stakeholders,” Imamura says.

[Related: JP buys 51% of BJ Ball and KW Doggett for $75m]

Ball & Doggett says JP is closely aligned with manufacturers in Japan and elsewhere also having broad distribution capabilities in other countries including the USA, India, Singapore and Europe.

“We look forward to learning more about JP in the near future and understanding how they operate in other markets. We are also keen to learn about products that are creating value to both their business and their customers,” the company says.

The company says, “Beyond this we will look to develop technology solutions that deliver value to our customers and invest in new products and ranges that are strategically aligned with long term global manufacturers. We will continue to engage and support a broad range of industry stakeholders including industry bodies, corporates as well as the design and advertising community.

“We respect that we are on notice from our customers as we bring Ball & Doggett to life. We cannot afford to be complacent or let our customers down. It is up to us to prove to our customers that this merger will deliver value to the industry. With the introduction of JP to Ball & Doggett, our company now has long term ownership and will therefore make decisions and invest to develop long term value to customers.”

Imamura says, “The purchase of BJ Ball and KW Doggett Fine Paper has just been completed and we would like to concentrate on this, to maximise the synergy. We would be willing to consider expansion into Europe, if the right opportunity presents itself.”

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter