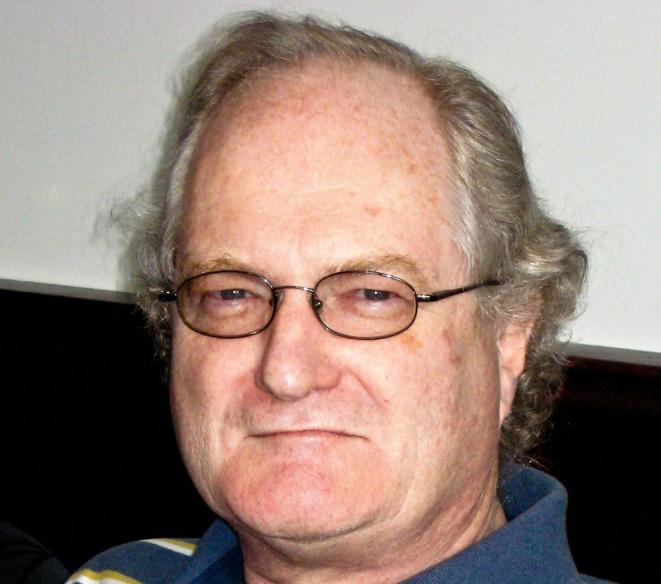

Men like Michael Liley are what the printing industry in this country badly needs. Business people. People with a financial background and management expertise who can blend these capabilities with a respect for (if perhaps not a traditional love of) the craft of printing.

Having only recently acquired the mid-size St Leonards (Sydney) based company, The Printing Department, through his Carbonbook Corporation, Liley has wasted little time in bringing his wide ranging business acumen to bear on the well established offset house. An exhaustive exploratory search which examined seven or eight potential buyout companies was undertaken with the help of one of the industry’s veteran print practitioners, former BAT packaging division general manager, Geoff Boshell, who came on board six months earlier and went on to become operations director once The Printing Department had been acquired earlier this year.

The major contributing factor to the acquisition demonstrates Liley’s financial insight in that he and Boshell were impressed not only by their takeover target’s profitability but by its well-accoutred shop floor in printing presses and prepress equipment.

The decision to purchase The Printing Department was also influenced by the fact that several of the other print suppliers Liley and Boshell examined, more often than not, were being offered for sale because the owners, lacking succession plans, simply wanted out. This was not the case with the former owner of The Printing Department, whose sale was prompted purely by other business interests.

Lure of corporate life too strong

“We didn’t want to have to begin by investing heavily in new equipment, so by acquiring a well-developed, modern shop we were able to hit the ground running,” Liley pointed out.

A longstanding career association with the National Bank of Australia in local and international marketing and general management roles ultimately took Liley into a venture capital company partnership, followed by his heading a Cambridge UK-based international IT operation. Before the acquisition of The Printing Department – with few apologies for little or no background in printing – he was an investment and management consultant. But the lure of corporate life was too strong and hence he recalls going out looking to buy a company in either Melbourne, Brisbane or Sydney.

His target’s criteria were totally focused. “It had to have scale, quality of output and a broad customer base,” he recalled. In addition, the ideal candidate company would benefit from new management systems, financial and marketing input and sophisticated customer segmentation and database inputs. These, he discovered, were attributes dramatically missing from many of the printing companies offered for sale.

“In the main they are run by printers with little expertise in marketing, finance or IT,” he remarked, observing also that one of the dangers facing many a medium size printer in Australia today is being “seduced” by high volumes, frequently with attendant low margins.

“Greater share of the wallet”

A banking term from his NAB days came to the fore when discussing ways in which Liley plans to broaden the product offering and profitability of his newly acquired printing operation.

He explained how bank management goes out of its way to snare a greater share of an individual person’s range of services needs. Translating that into product terms, the aim for his company of tomorrow will be to provide a series of integrated service offerings across a range of requirements that include, but are not exclusive, to printing.

The first hurdle was to successfully bridge the initial takeover period which, Liley indicated, “required a clear customer management strategy in place to provide the existing customer base with expectations of not only an ongoing stable supplier relationship but one which will improve on the past”.

The overall objective being pursued by Liley and his new management team encompasses future national distribution capacity, adding services diversification and adding a digital offering. He does not rule out further acquisitions, confirming that he has financial backing for the right opportunity.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter