Canon Inc. has posted a healthy FY2021 result with the company notching an 11.2 per cent rise to Y3.5 billion in sales and a 18.3 per cent increase in gross profit to Y1.6 billion with a final net income of Y214 million.

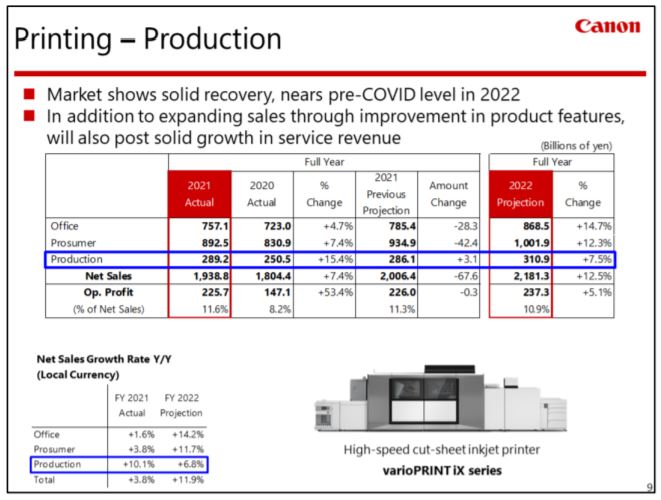

The production printing division posting a 15.4 per cent rise in revenue to Y289 million. Sales were up across all four business units printing, imaging, medical and industrial.

Canon Inc. Executive Vice President and CFO, Toshizo Tanaka, said in 2021 the company achieved significant sales and profit growth compared with 2020 when both were down significantly due to the impact of COVID-19.

He added that despite production bases being closed, issues around accessing components and logistical constraints that worsened, profit significantly exceeded the pre-COVID level of 2019 due to past efforts to continuously improve business activities.

Tanaka said the digital commercial printing market is showing healthy recovery from its COVID-induced contraction and is expected to approach its pre-COVID level of 2019 in 2022.

“In 2021, we received a large number of orders and achieved significant sales growth as printers like our varioPRINT iX series of high-speed cut-sheet inkjet printers, which have improved image quality, productivity, and media compatibility, were highly evaluated by printing companies for their quality of printed materials and total cost of ownership,” Tanaka said in the financial report.

“In 2022, we aim to significantly increase units sales by further improving the functions of all products, including continuous-feed presses, cut-sheet machines, and large-format printers. We will also make further improvement in profitability as service revenue is also on the rise due to increasing MIF.”

In terms of the FY2022 projection for Canon Inc., Tanaka said although there are concerns with the Omicron variant, it is expected the economy will grow at a fast pace of 4.4 per cent, following last year’s 5.9 per cent.

“Currently, the most important issues are the component and logistical constraints, which are expected to gradually improve. However, it will take a significant amount of time before the gap between supply and demand disappears, and for the time being, the inflationary trend due to shortages is expected to continue,” he said in the financial report.

“This year will be an important second year for us as we aim to make a further leap forward towards achieving the goals set out in our 5-year plan. In this regard, although it is difficult to foresee the future due to the prolonged components and logistics constraints, we are steadily switching to substitute parts, and expect to see a gradual improvement after bottoming out in the first quarter.”

He added that due to supply constraints Canon does have a large number of backorders which it is working through. At the same time the company is committed to ensuring product supply and linking this to sales.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter