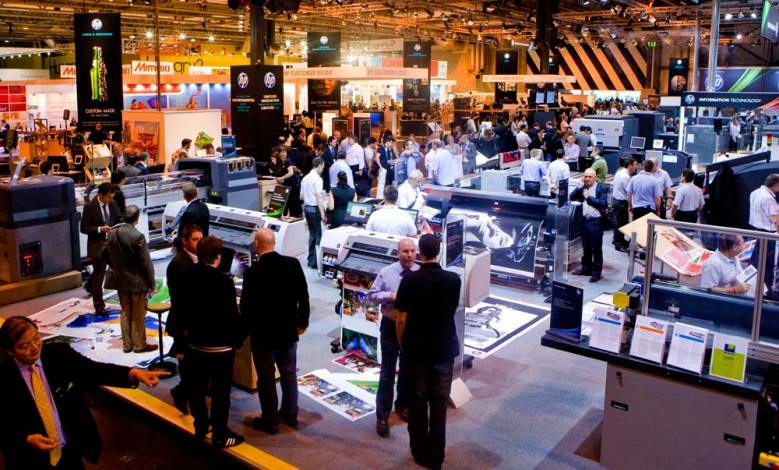

When the chips are down, people band together. The Brits call it “Dunkirk spirit”. Considering how tough, the years leading up to Britain’s biggest trade show have been, print people needed all the camaraderie they could get.

After all the economic challenges that have been thrown at the industry, it’s hard to imagine how things could get any worse. An ash cloud closing down European airspace the day before Ipex, perhaps? How about the threat of a BA strike paralysing the UK’s airports?

Yet Ipex 2010 should not be remembered for the GFC or even the Icelandic volcano, but as a turning point. It was a watershed in more ways than one. The sales figures coming off the back of those eight days of trading point toward an economic recovery. Of course, it’s typical for vendors to claim bragging rights for “record sales” at the close of a trade show. Only two years ago, Drupa exhibitors talked up the record deals and millions of dollars worth of kit shifted at the show. But as the doors to the Messe Düsseldorf closed, finance dried up and few of those leads converted to solid sales. But even accounting for exaggeration and marketing bluster, the confidence following Ipex indicates the clouds are parting. The positivity makes a refreshing change for an industry that has suffered a crisis of confidence.

Signs of an upturn were one of the trends at Ipex 2010 – another was the technological transition. This was best illustrated by the unprecedented floor space now devoted to digital rather than offset. But another, perhaps less obvious trend, was of collaboration, of partnership. Some of this can be put down to the industry coming together in the face of adversity. Vendors ProPrint spoke to at Ipex were thrilled at the promise it could be a “spending show”, not just on their stands, but across the industry at large to release a desperately needed flow of cash.

But some partnerships went deeper than rivals wishing each other well. The trade fair saw Canon and Océ sharing stand space for the first time since news of the digital mega-merger was announced last year. A Canon ImagePress C7000VP was at home on the Océ stand. The machine was plugged into Océ’s PrismaPrepare pre-press software, showing that the family connection will go much deeper than simply a shared parent.

Strength in unity

It was just one of many examples of the increased focus on workflow automation, by its nature a way for different products and rival technologies to integrate with each other. Heidelberg showcased the power of its Prinect workflow by talking up the 50-plus products with which it can integrate, from MIS and web-to-print software to digital kit from the likes of Xerox, HP, Canon and Kodak.

Heidelberg used its press conference on the eve of the show to reveal it would announce a tie-up with a digital manufacturer by the end of the year. It was a move away from the end-to-end, one-stop shop approach the manufacturer has taken in the past.

Heidelberg wasn’t alone in this digital love-in. Fellow German press maker KBA also nodded toward partnering in digital. KBA vice-president Klaus Schmidt admitted Ipex 2010 was a breakthrough show for digital. He said the future would continue to lie in the “coalition of offset and digital technology. Our [traditional offset] market will shrink, but not as much as some people are suggesting and digital will not explode as much either,” he said.

It seems those old adversaries – digital and offset – have struck up an unspoken truce somewhere between Drupa and Ipex. Arms have been laid down. Many conversations were about each technology having its own place in the market.

One company walking the line between these competing print processes is Fujifilm. Its new inkjet endeavour – the B2 sheetfed Jetpress 720 – could be seen as a direct threat to its bread-and-butter plate business. In an interview with the Ipex Daily, produced by ProPrint’s UK sister title, PrintWeek, Fujifilm senior vice-president, Ryuta Masui was asked “Are offset and digital enemies?”

“No, they’re complementary technologies,” said Masui. “The key is to use the right technology for the right application and that’s where our intimate understanding of both has value.” Fujifilm says the Jetpress is not offset-replacement per se, but aimed at a sweet spot between litho and toner of 500 to 2,000 sheets.

As a digital-only company, Xerox shouldn’t have any qualms about eroding the offset market. Yet it too was talking up a collaborative approach. Eric Armour, president of Xerox’s global business group, told the Ipex Daily that the future is “all about being complementary to offset”. He said the FreeFlow workflow products proves Xerox is keen to service both sides. “So much of the market operates in the digital and offset spaces, and they don’t want two different workflows – they want to make it seamless.”

Talking of an Ipex 2010 love-in, there’s another group of show-goers with a special relationship with the UK trade fair: Australians and New Zealanders. Our region made a strong showing at the NEC, proving that little things such as a volcano or financial turmoil wouldn’t stop us from staying up-to-speed with the latest technology has to offer.

It was the first Ipex for Southern Colour managing director Rod Dawson, and integration was foremost in his mind. Dawson was looking for workflow products to help marry up his offset press battery. “Workflow integration was our main focus, looking at MIS and web-to-print platforms and general automation. We are a complete Heidelberg shop – we want to put all the pieces together with workflow integration.”

As a loyal Heidelberg house – its press battery includes a 10-colour Speedmaster XL 105, six-colour XL 105 6 with aqueous, plus a five-colour SM 74 – Dawson is already predisposed toward the German press giant’s products. But he said that even so, he was still taken aback by the technology on display. “Yes, we are a Heidelberg shop but when you look at some of the stuff on their stand for on-press reporting and integration with MIS – it’s very impressive.”

While very much of an offset mentality, Dawson took time out to size up the inkjet innovations from the likes of Kodak and HP. “The inkjet web presses were just mind-blowing in their speed and colour.”

Dawson doesn’t see them as a threat to offset in the short-term, though he concedes that may change as the technology continues to develop. Dawson reckons inkjet could complement rather than just compete with litho. “There is some of the work we do at the moment that could fit. Not in the near future, but [colour inkjet machines] could be a really nice supplement to a sheeted print shop.”

A printer with a stake in both offset and digital is SOS Print and Media, run by managing director Michael Schulz. A veteran of Drupa – Schulz grew up in Düsseldorf and first went to the German show at age 10 – this was his second Ipex. He agreed that today the conversation is more about each process having its place.

“I think the euphoria that digital will replace offset has given way to the reality that offset will have a place for a fair while yet. On higher quantities, offset will still be the choice for quite a long time. Of course, inkjet is opening up higher quantities, but even with inkjet, it’s clear there are many things where offset is still relevant. Inkjet will take a while until it can print on offset stock,” he added.

However, despite offset still owning the long runs, Schulz pointed out that as run lengths continue to come down across the global industry, digital will keep taking volume away from traditional printing.

Schulz also said he saw a newfound positivity in the halls of the NEC. “It was a very upbeat show. It was a good atmosphere, much more that Print 09 in Chicago, which was much more subdued.” He said there seemed to be more deals happening at Ipex and more enthusiasm generally.

The new inkjet machines are aimed squarely at the high-volume transactional market. So who better to give a verdict than Salmat? The listed firm’s national operations manager, Chris Miller, was looking closely at the inkjet machines on display. “From a printing technology point of view, the standout new equipment was the Prosper by Kodak.”

But it wasn’t the only show-stopper for Miller. “The other machine that was a bit of a sleeper was the new technology on Xerox stand,” he said. The device in question wasn’t a saleable product but a “technology demonstration”.

Inkjet answers

Xerox first hinted at its entry into inkjet back at Drupa ’08, when then chairman Anne Mulcahy used the vendor’s press conference to make an enigmatic reference to “gel ink”. Pundits have had

to wait the intervening two years for more information.

But rather than more smoke and mirrors, Xerox provided visitors with a hands-on demo of the concept press, which hinges on the solid ink technology currently used in its office products such as the ColorCube.

It said the continuous-feed machine’s killer app was that it will open up a wide range of substrates, in particular the type of low-cost, uncoated stocks typically used for transactional print and DM. Xerox says the raft of aqueous inkjet options from its rivals can’t do justice to low-cost stocks due to paper curl and bleed through.

The press is still just a concept, with no shipping schedule announced and all demos done under non-disclosure agreements (NDA). Miller said: “Having attended the NDA session at Ipex and seen the machine’s current capabilities, it seems Xerox has put a lot of thought into the markets they want to serve.”

High-volume inkjet would seem right at home in a business such as Salmat, though Miller wouldn’t be drawn on specifics of its investment plans. “All I can say is that we are deep in discussion with our senior execs to agree on a capital expenditure plan and when we’ve done that we’ll be a position to move forward very quickly.”

If collaboration was a key trend at Ipex, the show was also about convergence. Miller agreed there were signs of partnerships between vendors at Ipex. But he added that as more printers adopt hungry, high-volume inkjets, they’ll adjust their go-to-market strategy to satisfy the machine’s appetite – blurring the lines between sectors. “As offset printers begin to implement inkjet solutions to cater for new markets, they will become competitors in the transactional market.” The reverse will also be true as transactional suppliers move into offset territory.

Ipex 2010 showed that printing technology and business sit on shifting sands. But the make-up of the show’s visitors points to another trend – print’s geographic shift. This year’s event was the most international in the show’s history. There was a huge surge in visitors from emerging markets, such as China, India and Africa. As the industry gets back on its feet after being hobbled by the GFC, it looks out on a different landscape. It’s one where technologies are sharing and stealing market position in equal measure. It’s a place where the business of print is changing so quickly that only the most forward-looking companies can keep up. It’s a place where the leaders of tomorrow could just as easily come from developing nations as from first-world economies. Who can say what convergence, consolidation and collaboration we’ll see by the time Ipex 2014 rolls around.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter