The biggest stock market floatation in the history of Australian print has been called off – for now. Blue Star parent company Ive Group decided to postpone its IPO yesterday afternoon, blaming market volatility as the reason it was unable to get the numbers needed. Brokers Bell Potter and Evans & Partners informed investors on Thursday afternoon before the 4pm bidding deadline that the IPO was being called off.

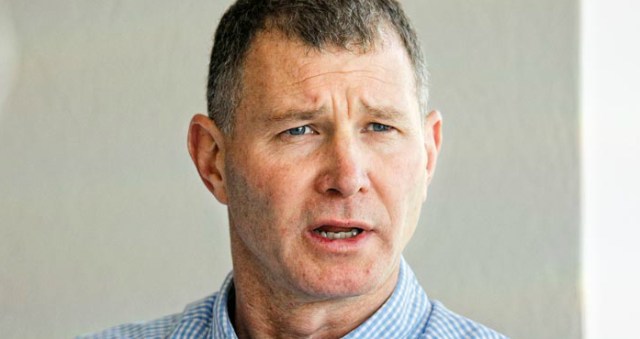

“Given underlying market conditions, the shareholders of Ive Group have decided to postpone their proposed IPO transaction,” they said. “Whilst there has been significant support for the IPO from a high quality group of investors right through the marketing period, the current short term volatility in the equity markets has impacted transaction momentum through the course of the past few days.” Ive executive chairman Geoff Selig said that deteriorating market volatility meant the postponing the offering was the best way forward, and said they will ‘wait for a better time to proceed’. According to the AFR the company had achieved a significant investor. The marketing communications company, which includes Australia’s biggest sheetfed printer, had been offering $2 to $2.22 a share to begin trading on July 2 with a $200m market value. Ive is reportedly forecasting $310.3m revenue and $26 million EBITDA in FY2015, and $355.7m and $37.5m in for 2016. This makes the aborted offer priced at 9-10 times the $19m forecast 2016 profit and 5.3-5.8 times forecast EBITDA. Blue Star is the biggest sheetfed printer in the country, in recent times it has become one part of the newly formed Ive group, which is now a broader communications and creative business. Ive is currently owned by the Selig family and private equity backer Wolseley.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter