A reorganised Kodak has just emerged from its 20 month stint in the US Chapter 11 bankruptcy protection, with the company now focused on the commercial print and packaging markets.

Steve Venn, managing director of Kodak Australia told Australian Printer, “It’s a great day, for Kodak and for the printing industry. This iconic company is back on firm foundations. And it is a shot in the arm for printers, Kodak could have gone onto many sectors, but chose printing and packaging, which shows the confidence they have in the future of the industry.”

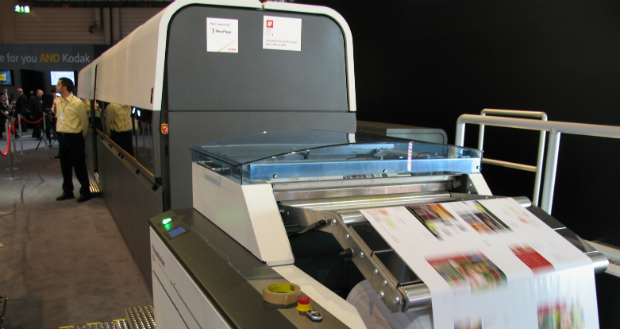

Venn says, “I would make three key points. First Kodak is now a B2B operation focused on commercial imaging. Second we are technology leader, although Kodak sold some 15oo patents while in Chapter 11 it still has more than 7,500, and will be working hard to bring these to market. And third Kodak will be focusing on working with printers to highlight and develop new business opportunities, for instance with our Stream print heads on offset presses for hybrid offset digital printing.”

Antonio Perez, the chairman and chief executive officer of Kodak, announced the company’s emergence from Chapter 11 today following completion of the final steps in the restructuring process.

He says, “We have emerged as a technology company serving imaging for business markets – including packaging, functional printing, graphic communications and professional services,” said Perez. “We have been revitalised by our transformation and restructured to become a formidable competitor – leaner, with a strong capital structure, a healthy balance sheet, and the industry’s best technology.”

The Chapter 11 protection was only applied to the US business, in Australia as in the rest of the world Kodak has been trading profitably throughout its sometimes painful transition from the analogue film producer it built its business on to a digital solutions developer.

Kodak completed the final steps in its Chapter 11 restructuring, including the spin-off of its Personalised Imaging and Document Imaging businesses to Kodak Pension Plan, a longstanding pension plan of Kodak’s UK subsidiary. The company also successfully closed on its agreement for $695m in term exit financing, paid off its DIP lenders and second lien noteholders in full, and completed its rights offerings, receiving approximately $406m of new equity investments from participating unsecured creditors.

Perez says, “We are setting a trajectory for profitable growth. We have the right technology at the right time as printing markets increasingly transition to digital. Our broad portfolio of offset, hybrid and digital solutions enables customers to make the transition at their chosen pace using our breakthrough technology solutions.

The company has filed notice of the effectiveness of its Plan of Reorganization with the US Bankruptcy Court for the Southern District of New York. Upon the effectiveness of the Plan, all previously issued and outstanding shares of Kodak common stock were cancelled, as were all other previously issued and outstanding equity interests. Kodak issued shares of a new class of common stock to participants in the rights offerings and will issue additional shares of this new class of common stock to unsecured creditors as provided in the Plan of Reorganization. Kodak expects to make initial distributions on account of general unsecured claims by the end of September.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter