The liquidators of Starleaton Holdings claim the business was insolvent from at least 1 July 2022 and potentially even earlier.

In the latest report prepared for creditors of Starleaton Holdings by liquidators Andrew Blundell and Simon Cathro of Cathro & Partners, some detailed financial reports indicate the business was trading insolvent from 1 July 2022, and potentially earlier.

Here are extracts from the creditors report dated 11 September 2025:

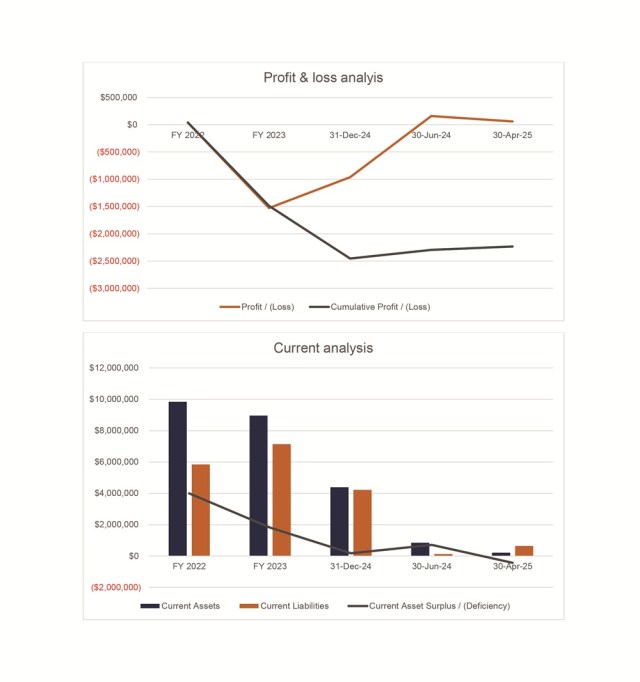

“Starleaton Holdings recorded sales of approximately $17.2 million in FY22 and $21.2 million in FY23. However, revenue declined sharply from FY24 onwards, falling to $593,999 for the three months from April to June 2024 (the periods when the trading was handed back to the Director) and only partially recovering to $1.69 million for the ten months ended 30 April 2025 during the DOCA period. This represents a significant reduction in Starleaton Holdings’ operational scale.

“Gross margins reduced from approximately 37% in FY22 to 29% in FY23, consistent with increased cost of sales relative to revenue. While margins appear to have improved in FY24 and FY25 (exceeding 70%), this is largely attributable to the sharp fall in sales volumes and does not represent a sustainable trading margin.

Starleaton Holdings reported minimal profitability across the periods. A marginal profit of $38,798 was recorded in FY22, followed by a significant loss of $1.53 million in FY23. For the period to December 2023, Starleaton Holdings recorded a further loss of $964,578. While small profits of $158,311 and $60,152 were reported as of 30 June 2024 and 30 April 2025, respectively, these results are not considered sustainable given the decline in revenue and the expense base historically required to support its operations.

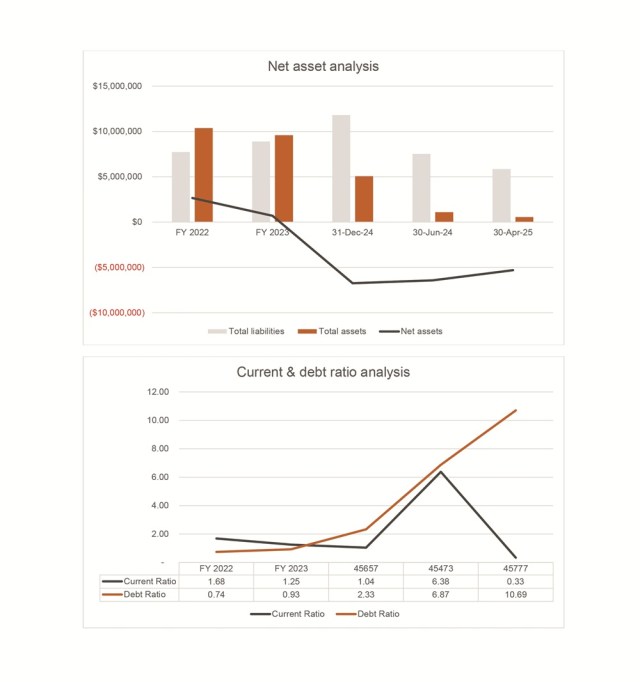

“The reported balance sheet indicated net assets of $3.27 million as at FY22, reducing to $1.75 million as at FY23 and $581,979 as at December 2023. However, following adjustments to remove unrecoverable assets (related party loan accounts), the adjusted net asset position fell to negative $6.74 million as at December 2023, negative $6.43 million as of 30 June 2024, and negative $5.31 million as of 30 April 2025.

“The related party loan accounts reported in the balance sheet were essentially amounts receivable from entities or persons connected with the company. In practice, these balances were not collectible because the counterparties lacked the capacity or commercial intention to repay. As such, they could not be relied upon as an asset to support the business. Their removal from the balance sheet was necessary to present a realistic view of Starleaton Holdings’ financial position, which, once adjusted, revealed a significant negative net asset position.

“The deterioration in the adjusted net asset position reflects that a significant portion of the Starleaton Holdings reported assets were not realisable. On a realistic basis, the Company had no capacity to meet its financial obligations, with liabilities exceeding assets by between $5 million and $7 million across the noted periods.

“Starleaton Holdings’ liquidity position also deteriorated. While the reported current ratio appeared favourable (8.11 as of 30 June 2024), the adjusted current ratio was only 6.38 and subsequently reduced to 0.33 as of 30 April 2025. This indicates that by FY25, it had insufficient liquid assets to meet its current liabilities.

“Since July 2022, Starleaton Holdings has had a growing liability to the ATO since its BAS lodgement in the same period. Since this date, the liability increased from approximately $74,000 to over $875,000 by the date of our appointment as VA. While there were a number of repayments made and payment plans entered into by Starleaton Holdings, they were not sufficient to discharge its older debts, and the ATO liability continued to increase, as it met its ongoing lodgement requirements.

“Accordingly, we are of the opinion that Starleaton Holdings was insolvent since at least 1 July 2022 and likely earlier based on our preliminary investigation.”

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter