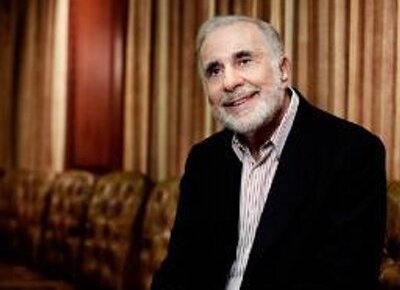

The Miami Firefighters Relief and Pension Fund has allegedly filed a lawsuit against Carl Icahn for having prior knowledge about the potential HP/Xerox deal when buying shares in HP, according to a report.

Bloomberg mentioned that the Xerox shareholder has sued Icahn and an investment vehicle controlled by him, High River Limited Partnership, for buying US$1.2billion in HP shares knowing that Xerox was intending on acquiring the business.

The report further alleged Icahn and High River Limited Partnership for “breaching their fiduciary duties to Xerox by buying HP stock with the knowledge that Xerox was either considering making an offer to purchase HP, had already approached HP about a possible merger into or acquisition by Xerox, or of the obvious merits of Xerox’s potential acquisition of HP”.

Icahn is one of Xerox’s largest shareholders – he owns about 11 per cent of the company’s stock as of 30 September and almost five per cent of HP shares. Together with High River Limited Partnership, they own more than 62.9 million HP shares.

Earlier this month, Icahn issued an open letter to fellow HP shareholders urging them to push HP’s board of directors to accept Xerox’s $US33.5 billion takeover bid.

In the letter, Icahn launches a stinging tirade about HP’s refusal to engage in mutual due diligence processes while also questioning whether this refusal is also about preserving the “lucrative positions of the CEO and members of the board”.

HP’s board of directors gave Xerox the thumbs down on its offer to buy the business for US$33.5 billion, citing concerns about Xerox’s declining revenue and future business trajectory.

“I cannot believe that the recalcitrance of HP’s board is driven by any real confidence in its standalone restructuring plan, which the market, shareholders and analysts met with extreme indifference and which seems to amount to little more than rearranging the deck chairs on the Titanic,” he said, in the letter.

“It is absurd for the HP board and management team, with such a history of underperformance and missteps, to claim to have had a sudden epiphany and now expect shareholders to trust them to execute a standalone restructuring plan rather than to even explore an opportunity to enter into a combination that could bring about a much needed $2+ billion of cost synergies and possibly save the company.”

Following Icahn’s letter, Xerox vice-chairman and CEO John Visentin proposed to HP shareholders a counter offer, which included US$17 per share in cash and 48 per cent of the pro forma of the combined company, which he said he believes is worth US$14 per share.

“By harvesting these synergies, which can only be realised with this combination, the new pro forma company will be both more profitable and better positioned to provide customers with a stronger mix of products, services and support than either company can do on its own,” Visentin said, in the proposal.

Icahn has yet to comment about the claims.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter