Blue Star parent Ive is set to open its bookbuild on Monday, with the company looking to sell $75.6m worth of shares which will represent 42.5 per cent of the business as it seeks a successful IPO. The share offer values Ive at $177.7m, down from the $200m valuation in the June offer, which did not cross the line due to the severe market volatility at the time. It will still be the biggest float in Australian print. Ive is forecasting $355.7m revenue, $37.5m EBITDA and $19m in profit for 2016, the AFR says the yield for invetsors will be around eight per cent. The prospectus will come out on Tuesday, and if all goes to plan the company will launch on December 18. The terms leave the Wolseley private equity fund with 38 per cent of the business and the Selig’s with around 15 per cent.

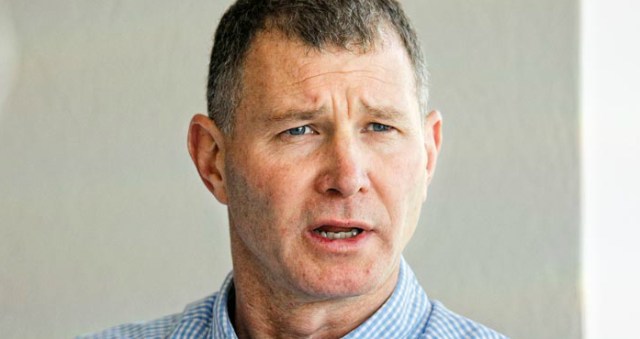

Ive executive chairman Geoff Selig is steering clear of public comments for the moment. The Ive Group includes the Blue Star division, which houses country’s biggest sheetfed printer Blue Star, the Webstar web offset business, the newly formed retail display business, its digital print business, and its mailing operation. It also includes Ive’s two non-print divisions and the newly acquired Pareto telemarketing business. Ive has been rapidly acquiring businesses over the past year, with only one, Scott Telfer’s Oxygen, a sheetfed printer.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter