Recently filed figures reveal that Kodak’s results for 2011 were awash with red ink. US sales at its consumer business halved to US$864 million ($825 million), and were down 36% overall worldwide at $1.7bn.

The previously profitable division went into reverse by more than half a billion dollars, moving from a $278 million profit in 2010 to a $349 million loss in 2011. Kodak said this was “largely due to the decrease in revenue from the non-recurring intellectual property agreements” as well as price competition in consumer markets.

Last summer the group said it would sell off a raft of its digital imaging patents, a process that stalled in the run-up to Chapter 11 due to legal technicalities, including ongoing patent infringement claims against Apple and RIM.

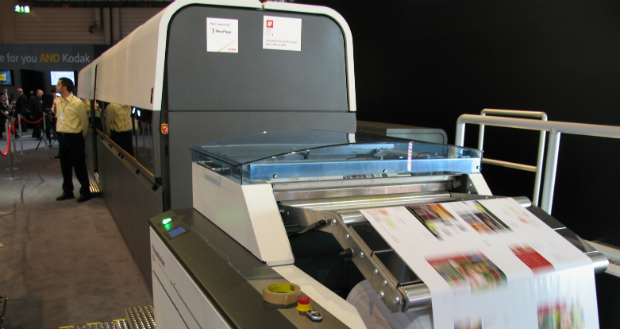

Losses at Kodak’s Graphic Communications Group doubled to $191 million, on sales that nudged up 2% to $2.7 billion. Gross profits fell 19%, which Kodak blamed on industry price competition. It put increased costs at its digital printing business down to “continuing start-up costs associated with the stabilization of the Prosper printing systems”.

The only part of Kodak to post a profit was its Film, Photofinishing and Entertainment Group, where profits fell by 63% to $34 million, on sales down 12% at $1.5 billion.

Kodak’s bottom-line loss for 2011, including a $133m restructuring charge, was $764 million, with sales down 16% at $6 billion.

Earlier this month a meeting of Kodak creditors was held in New York. Court filings reveal that Kodak’s general unsecured creditors are owed many millions of dollars.

PrintWeek has made this list available here

A host of graphic arts-related suppliers are among those waiting to find out if they have any hope of recovering the monies owed.

Printing equipment and services suppliers are among those listed, including District Photo, which lays claim to being the world’s largest producer of direct-to-consumer photo products, and is the parent group of Harrier LLC. It is owed $1.5 million.

Online print services specialist Mimeo.com also has an outstanding bill of $795,076.

Some of Kodak’s creditors – including Mimeo.com, which runs Nexpresses – are in the unusual position of being a creditor, an ongoing supplier, and a customer of the embattled imaging giant.

Under the Chapter 11 process, Kodak is able to pay for goods and services ordered subsequent to its bankruptcy filing in January. And some creditors have been able to make so-called reclamation claims relating to items supplied in the days immediately prior to the filing.

Kodak had floated plans to create a two-tier system of creditors to avoid problems with its critical suppliers, but this process has been shelved.

Lawrence Gamblin, president at Collins Ink, believes unsecured creditors have little chance of being repaid no matter what the outcome is of Kodak’s Chapter 11 process. Collins is owed $1.9m.

“The situation with Kodak will only work out positively for creditors if Kodak somehow manages to sell the patent portfolio they put on the market for a large number. Otherwise there are too many people in line ahead of unsecured creditors like Collins,” he said. “Even if Kodak realizes an enormous windfall from the patent sale, it is hard to see Kodak going back and repaying unsecured creditors.”

Kodak has yet to file its reorganisation plan, which will include information about the likelihood of trade creditors being paid or not.

Some of the largest amounts are owed to suppliers that are part of Kodak’s global sourcing operation. Chinese electronics manufacturer Nanjing Wanlida, which includes digital photo frames in its product offering, is owed $3.7 million.

In the UK, aluminium strip manufacturer Bridgnorth Aluminium has an outstanding debt of $47,243, while graphic arts chemicals producer Varichem is owed $58,620.

Also listed among the unsecured foreign creditors is Switzerland’s Matti Technology, which specialises in high-speed inkjet printing systems. It is owed CHF35,000 ($36,835).

Managing director Dieter Woschitz told PrintWeek: “Our bill is for a lot of small parts – things like lamps and switches. We have not written it off, but we don’t know how we can get it back.”

The enormous costs being incurred because of Kodak’s bankruptcy became even clearer this week, when the first wave of bills relating to legal and financing costs during the January 19-February 29 period were filed. Banker Lazards Frères has sent in a bill for $7 million; lawyers Sullivan & Cromwell has claimed for $5.4m of work done; Young Conaway Stargatt & Taylor has billed $692,000; while fees at Linklaters for the same period were $323,292 and at Groom Law Group were $31,616.

This article originally appeared at printweek.com

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter