(Pictured above:) Messe Duesseldorf director drupa and global head print technologies Sabine Geldermann

The 9th drupa Global Trends Report, to be published in November 2023, is a clear statement of increasing confidence across almost all regions and markets. Printers and suppliers alike forecast it will be even better next year, good for drupa 2024.

The findings come from the 9th Global Trends in-depth survey, run this spring by Printfuture (UK) and Wissler (CH), when over 600 printers and suppliers from the drupa Expert Panel of senior decision-makers. Globally, 32 per cent more printers and suppliers described their company’s economic condition as ‘good’ compared with those that reported it as ‘poor’. Amongst printers, almost all regions and markets were more buoyant than in 2019 (pre-COVID).

Printfuture operations director Richard Gray said, “While positive forecasts might be expected from packaging and functional printers, what was pleasing was the increasing confidence amongst commercial and publishing printers.”

It appears that commercial and publishing printers have weathered the worst of the impact of digitisation and are starting to plan ahead with more confidence.

The source of such confidence across all markets is clear from the financial performance figures provided. Globally 50 per cent more printers raised prices in 2023 than lowered them, sustaining the pattern of last year, after the previous seven years of falling prices. Better revenues and margins have followed. This pattern was true across all markets, although there were regional variations.

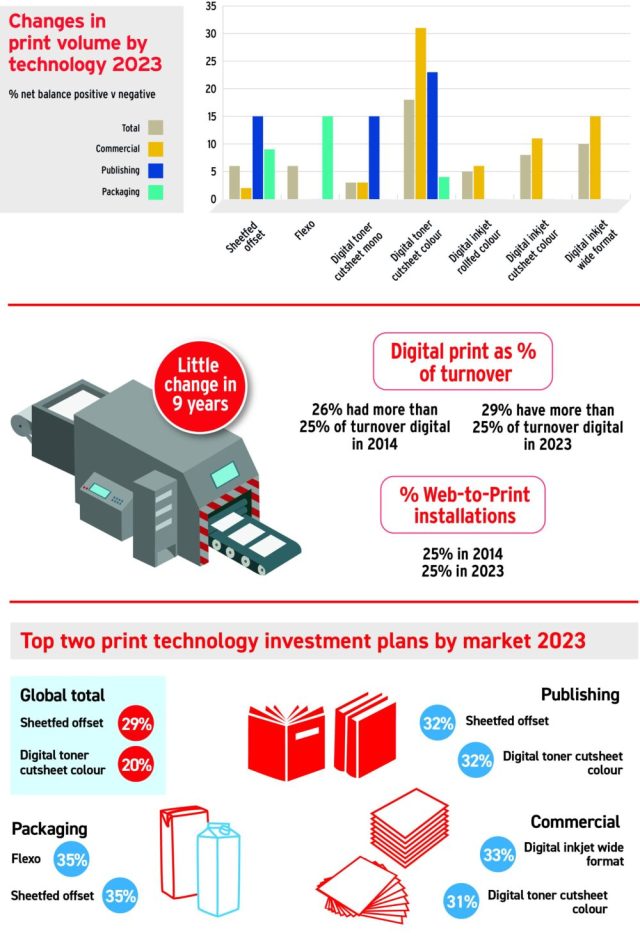

The resilience of sheetfed offset print volume across all markets is remarkable, matched amongst packaging printers by growth in flexo. Digital toner cutsheet colour print volume remains the leader among digital print technologies. Globally the digital adoption (printers claiming more than 25 per cent of turnover in digital) is growing from 26 per cent in 2014 to 29 per cent in 2023. At first sight, this is only a modest growth. However, various industry sources show volumes have grown significantly since 2014, even though the digital adoption rate appears to be slowing down.

Capital expenditure tumbled during COVID, recovered a little last year, and accelerated this year with 27 per cent more printers investing more in 2023 than those who reduced expenditure, a better global figure than any year since 2017. An even higher investment rate is forecast for 2024 by both printers and suppliers. Print technology and finishing remain the most popular targets, with sheetfed offset and digital toner cutsheet colour being the most popular technologies globally. However, there are significant variations by market.

Strong industry growth forecasts must be balanced by recognition of stiff economic headwinds, with the risk of recession, or at least damaging inflation, now outweighing the impact of the pandemic and a wide variety of more specific regional socio-economic concerns.

Messe Duesseldorf director of drupa and global head print technologies Sabine Geldermann said, “Printers and Suppliers know they must innovate to succeed in the longer term. I am confident that drupa 2024 will be the ideal opportunity to explore how best to achieve this objective.”

The full report in English will be released by mid-November and will be available for sale from www.drupa.com. The executive summary will be available for free in German, English, French, Portuguese, Spanish and Chinese.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter