Packaging giant Orora has revealed strong half year results, delivering a double-digit net profit after tax (NPAT), earnings before interest and tax (EBIT) and earnings per share (EPS) growth.

The company’s NPAT was $105.7m up 14.8 per cent from $92.1m the year before, with sales up 6.2 per cent to $2.09bn from $1.97bn for the same period a year ago.

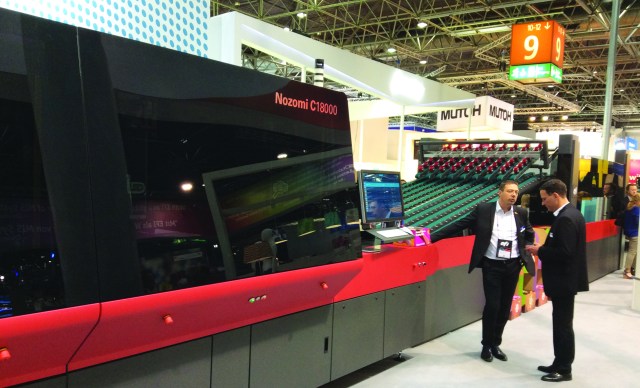

Orora has ordered Australia’s first EFI Nozomi large format corrugated digital printer, which will go into its Oakleigh site in April or May. The company has also ordered a second Nozomi for its US operations.

Nigel Garrard, managing director and CEO of Orora says, “Orora’s track record of delivering strong and sustainable earnings growth has continued, driven in the first half by organic growth in the Group’s core businesses and enhanced by the benefits now beginning to flow from recent acquisitions and capital investments to deliver customer led product solutions and improve productivity.”

During the half year, Orora’s statutory net profit after tax was $103.8m and its gross organic capital expenditure of $93m.

Garrard says, “Based on the success of recent or organic investments, the current focus is to invest to support organic growth and to bolster the capability to drive the integration of the Orara Visual acquisitions, while continuing to evaluate acquisition opportunities against Orora’s strategic and financial hurdle rates.”

[Related: Orora profit up 14%, debt rises]

Orora Australia delivered an 11.1 per cent increase in EBIT to $121m, with sales revenue 5 per cent higher to $1.0424m. The company says both Australasian business groups – Fibre Packaging and Beverage – delivered earnings growth despite flat economic conditions and higher input costs.

Significant item expense after tax of $1.9m related to net profit on sale of Fibre Packaging’s Smithfield site offset by costs related to the restructure of Fibre Packaging in NSW including the closure of the Smithfield site and potential additional decommissioning costs associated with Petrie Mill site

The company is also securing a long term power purchasing agreement with global renewable energy provider Pacific Hydro, to supply wind-generated electricity for Orora’s SA operations, including its Gawler glass facility. Under the agreement, Orara will have a long term supply of renewable energy from Clements Gap Wind Farm, for a volume equal to Orora’s total electricity demand in the state.

Garrad says, “Orora operates energy intensive businesses and is continuing to actively investigate a range of options to manage higher energy prices and safeguard supply for the Australian operations.

Fibre packaging earnings were higher driven by increased volumes and efficiencies at the NSW botany B9 recycled paper mill (89) steady sales growth in targeted market segments and benefits from recent capital investments which more than offset input cost headwinds. Earnings growth in the beverage business was driven by higher glass volumes on the back of continued industry growth in bottled wine exports and delivery of further operating efficiencies.

Orora North America Ebit increased 13.5 per cent to US$47m and sales revenue grew 11.11 per cent to US$822.3m

Orora packaging solutions (OPS) achieved solid organic sales growth and increased margins by continuing to target higher growth market segments, leveraging its national footprint, product breadth and standardised service offering and driving operating efficiencies. The integration of Orora visual point of purchase (POP) acquisitions continues, with financial results improving. Additional resources have been employed to add the capability required to help drive the business forward

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter