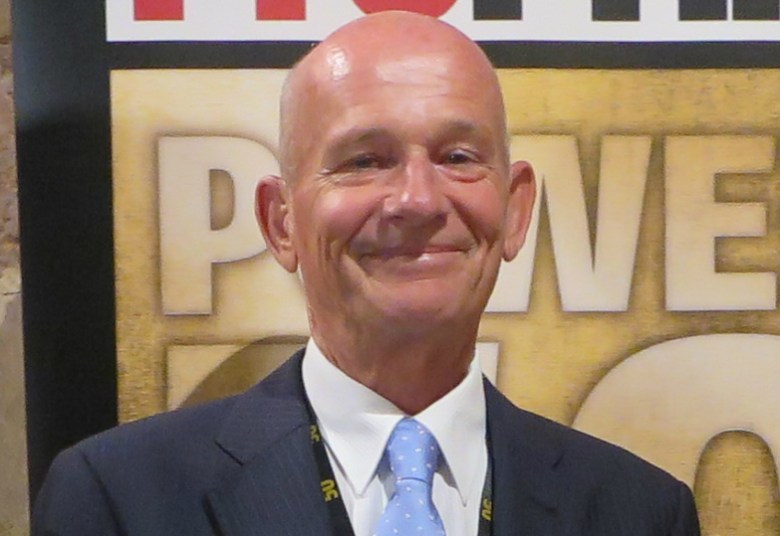

PMP has revised its full year 2017 profit forecast down by around a fifth, to an EBITDA of $31m-$34m from its previous $36m-$41m, with CEO Peter George blaming lower than expected print sales with lower than expected customer churn due to the impending merger.

However George says that profits will trend upwards in the next two years, expecting an EBITDA of $70m-$75m in 2018, and $90m-$100m in 2019. He also says PMP will be net debt free by 2019.

Speaking to investors George says that market conditions remain tough, with retailers controlling costs, while publishers are seeing print runs and paginations under pressure. Delays in union consultations and retail sector weakness contributed to the downgrade.

However George says the company is winning new business, and is expecting to re-sign key customers to a value of $130m by the end of June. He also says the merged business will have implemented annual cost savings of $40m by the end of the month.

It will continue to work with independent print brokers and print managers as a partner rather than a competitor.

[Related: PMP makes Offset Alpine sheet centre]

PMP is expecting $1.2bn revenues this year, split between Australian print at $460m, Gordon & Gotch Australia at $430m, Australian distribution at $80m, its Australian digital business at $40m, and New Zealand at $180m.

George says PMP has 55-60 per cent market share in Australia for heatset web. Its distribution business has a 35 per cent market share. Gordon & Gotch is the country’s number one magazine distributor.

The company is not expecting to make much in the way of capital expenditure over the next few years, having consolidated its press line-up following the merger with IPMG and having retired its older presses with a resulting 25 per cent reduction in heatset capacity. George says this should see more alignment between supply and demand over the medium term, leading to more stable pricing and improved returns on capital invested.

PMP now has 22 heatset presses, including the only 96pp presses in the country, which print nine tonnes of paper an hour.

George says the merger between PMP and IPMG went through with a high level of efficiency, and that the period of risk of disruption is now behind it. Equipment relocations are currently in full swing, and expected to be finished by end of July, with the company ready for the traditional upswing in work come August.

Merger costs including the closure of three sites have cost the business $75m, less than the $80m forecast, leading to a 1.4 year payback rather than 1.5 years.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter