The biggest piece of advice Graham Morgan of Morgan Shaw Advisory provided business owners looking to sell or merge their businesses in this week’s Power of Print webinar was knowing what your business is worth and also where you want to be in the coming years.

Morgan said the print industry does buy and sell businesses well but sometimes it does not work out so well so he has provided some tips and guidance to help.

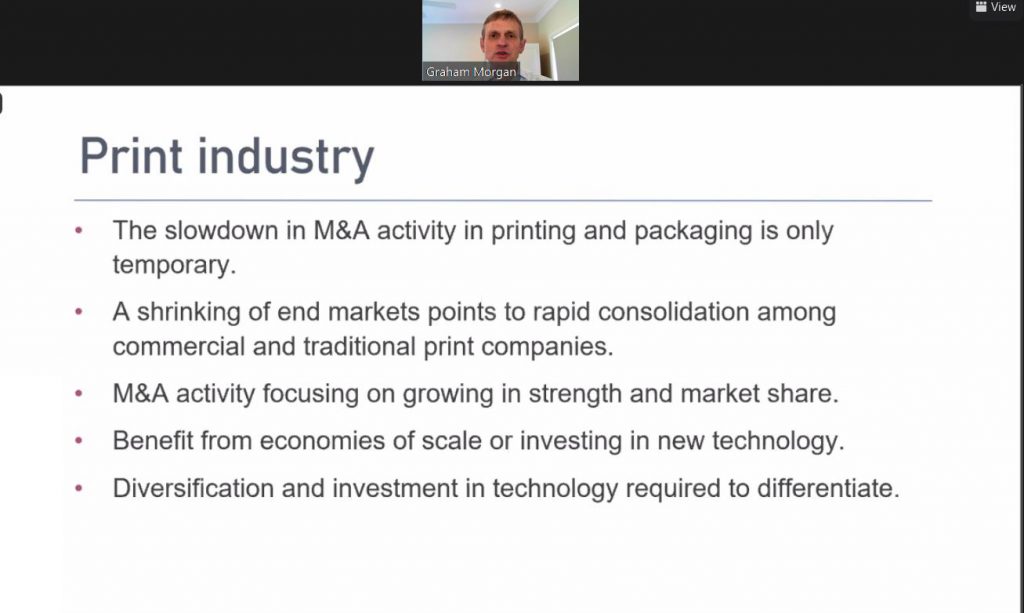

He also said in the current climate distressed mergers and acquisitions will be an opportunity to business owners looking to increase their customer base and cash flow.

“Distressed mergers and acquisitions will be an opportunity and this is an opportunity to pick up some assets which could help your business greatly. Private equity is the main driver of the mergers and acquisition activity going on in the mid market,” Morgan said.

“Post COVID many businesses will realise they can’t hibernate and will see merger and acquisition as an opportunity to grow businesses.”

Being game ready

Morgan said whether you are buying a company, selling your own business, merging or preparing to pass the business onto the next generation it is very important for all business owners to know your financial management accounts properly.

“Your management accounts will give you insight into your business and the key drivers of profitability. You also need to understand your balance sheet and look at the history of the company,” he said.

“You also need to pick a point in the future and decide where you want to be. This is important to think through the personal aspects as well as the financial.”

Next up is building a plan and doing the work to get you there and Morgan said this is often impeded by being very busy running the business or your personal life changes such as illness or divorce. External factors like COVID, a GFC and bushfires are also road blocks to planning.

“Around 80% of people want to get the top value for their business but only 30% truly understand what the value of their company is and 83% didn’t know how much money they would need to support their retired life,” Morgan said.

What defines the value in a business

Morgan said profit and EBITDA as well as quality of a business, ie its staff, contracts and history, define its value.

“You also need to show industry attractiveness and positioning and its unique selling position, client mix, team and management, profit margins, growth past present and future, asset quality (machinery IP) and internal processes,” he said.

Selling is complex

Morgan said less than 1000 businesses a year are sold successfully in Australia each year.

“Most business owners that try to sell their own business often fail because of lack of knowledge about how to manage the process and people also get very emotional when buying and selling businesses and the third factor is time as other things come in the way,” he said.

Morgan also said three topics tend to be top of mind for anyone who has ever sold a business – Negotiation, Due Diligence and Legals.

“What people don’t remember is all of the things that happen under the water most of which you can do in advance of selling and the more work you do there and the better looking the business is so that when it comes to the negotiation the business will sell itself,” he said.

Asset Purchase v Share Purchase

Morgan explained that in a share purchase, the purchaser is buying the shares in the company and that includes employees on their current contracts. An asset purchase relates to the purchase of specific business assets.

“There is no right or wrong in either model depending on the nature of the transaction but they’d have different tax consequences so you need to speak to a specialised tax accountant to find the best path for you that does not disadvantage you from a tax perspective,” he said.

To watch the recording of this webinar, please click here.

Next week’s Power of Print webinar features Mark Davies, managing director, Whistl (Doordrop) Media Ltd who will discuss ‘The Letterbox – print’s comeback in the United Kingdom‘. To register for that webinar please click here.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter