Treasury is currently reviewing a ban of paper billing fees for Australian consumers.

Treasury is seeking submissions from consumers and consumer advocates, businesses and environmental groups.

It estimates the annual cost of a ban would be between $80m and $93m for the 16 Australian businesses with the largest customer base, compared to the cost of abolishing ATM fees for the four banks being $500m a year.

Last week saw a consultation between Treasury representatives and campaign group Keep Me Posted, which has been working on legislative reform to ban fees for 18 months. In the lead up to the consultation, Keep Me Posted worked with the minister of consumer affairs’ office.

Treasury’s consultation paper explores the costs and benefits of five options, including the prohibition of paper fees. Keep Me Posted says it is the only option that can guarantee consumer protection against unfair and discriminatory charges.

[Related: NSW bans fees on energy bills]

Kellie Northwood, executive director, Keep Me Posted says, “We clearly stated Keep Me Posted’s position to support a total ban on all billing fees, which is option 2 of the consultation paper. We call on all Australians, industry stakeholders, interested groups and consumers to have their say and support the ban.”

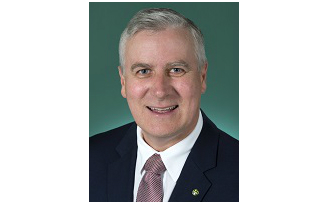

Michael McCormack, minister for consumer affairs says, "There has been a significant shift away from paper billing in recent years. Yet not every Australian consumer has the means to access digital billing and it is unfair to punish them for being unable to do so. Better outcomes and protections are needed for those consumers who do not have the option to transition to digital bills and who can least afford to be penalised."

Keep Me Posted says electronic bill are not a free option for consumers. Northwood says, “When you opt-in to electronic bills and statements it means you need to possess and keep an electronic device, pay for an internet subscription or for mobile data, and more often than not you pay to print the bill at home.”

Shadow minister for consumer affairs, Tim Hammond moved a motion in Parliament to ask the Government to restore consumer protection in June. He says, “We’ve got to restore the playing field for those who don’t have easy access online to make sure they are not getting stung for paper bills.”

Northwood says, “For Australians consumers, we really want the issue to be solved as soon as possible. It’s time for Government to apply a bit of good old fashioned common sense and make it clear to super profit companies that hidden or added costs along the way are not acceptable.”

Australians have until Friday 22nd December to make a submission.

The big financial and energy companies began charging for paper bills a few years ago as part of their drive to switch their customers to online billing, which they marketed under the environmental guide but which in reality was a moneysaving exercise for them.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter