A number of factors are combining to dramatically push up the cost of sea freight with delivery delays also lengthening.

COVID-19 is a major driver of the issue but there has also been a contraction in the number of shipping companies and trade flows impacting trade routes and therefore timelines. A COVID-19 induced displacement of shipping containers around the world is also contributing to the problem.

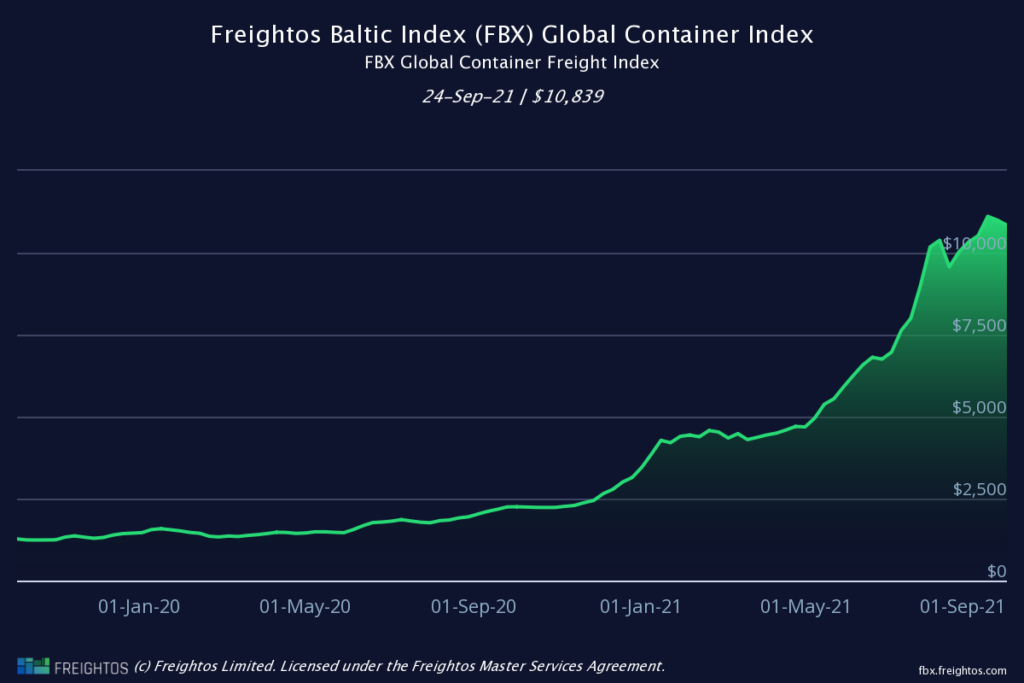

Shipping Australia, a peak body which represents the shipping sector in Australia, says according to Baltic / Freightos before the pandemic the global average freight rate for a 40-foot box was $US1446 and on September 3 2021, that had risen to $10,519.

A recent Boston Consulting Group report on global sea freight indicates there has also been unprecedented demand (200-300% plus compared to pre COVID levels) for sea freight. It also pointed to the increasing impact of ‘net-zero’ shipping and environmental regulations as well as a change in global trade flows as impacting the sector.

The Boston Consulting Group also makes the forecast in its report that COVID-19 disruptions are expected to resolve over the next 24 months, with prices expected to settle 10-30% above pre-COVID levels.

Australia is also suffering woes on the wharf with industrial action slowing down the unloading rate.

Make sure your quotes are fresh

Neil Southerington owns Graffica, a company which imports machinery into Australia from the UK, Taiwan, China and Portugal for the corrugated board print packaging market.

His biggest piece of advice to anyone considering buying equipment is to make sure they get an updated quote with current sea freight costs and delivery timeline details.

He says two of his recent shipments from Europe cost double the 2019/20 price and after machine testing and packaging, they took an extra five weeks to find a place on a vessel, let alone arrive in Australia and be unpacked.

He said the situation out of China was worse with one oversize 40,000-kilogram flat rack increasing to $45,000 from $31,000 with a doubling in delivery time.

“I’ve got one order which is late because China is on 50% power in the industrial sector at the moment and it is going to be another two weeks before it even leaves. The shipping has also gone from $25,000 to $45,000 which is a lot of money,” Southerington told Sprinter.

“The shipping is not negotiable – it is take it or leave it because they can fill the boat anyway.

“I’ve got two 40-foot containers here for Sydney. Originally it was $US9000 but it ended up being $US19,000.”

Southerington says he will carry these extra cost as he didn’t allow for them in the quote, but going forward this will change.

“I think people who are looking at buying a new machine and are working on old figures and old delivery times should ask for an update from whoever their supplier is. They need to ask what they think the timeframe is for manufacture and CIF (cost of insurance and freight),” he said.

Southerington said the reasons for the increases are not totally clear.

“With the vessels I use to get goods from one of my suppliers in China, it used to be 16 days because it came direct from Ningbo (China) to Melbourne or Sydney, but now it stops at four ports along their industrial seaboard so that has doubled our lead time to 30 days,” he said.

“They are filling the boats to the point where every available inch is full.”

Konica Minolta orders extra to prepare

Konica Minolta General Manager Sue Threlfo said freight has definitely been challenging these last 18 months.

She said to help deal with the bottleneck, Konica Minolta took the step earlier in 2021 to order in excess quantities of production printing equipment so it had product on the ground to meet demand from the industry.

“There has been uncertainty of when containers will leave their port, and then delays both on the water and in being processed in Australia,” Threlfo told Sprinter.

“In the past we also relied more on airfreight if there was a shortage of stock, however this has become extremely hard to procure, and triple the cost. So this required significantly more forward planning to ensure we have all the components available to be able to deliver our solutions to customers when they are required.

“Earlier this year, we took the opportunity to order in an excess of our production printing equipment so that we could meet the market demand. We don’t see this easing in the short term, with the demand high remaining high, and availability of containers and freight space low.”

Konica Minolta national supply chain manager Bashir Mourad expects the issues to continue for at least another 12 months.

Mourad says there has been an exponential increase in international container chargers over the last 12-18 months (as seen in chart above) with some shipping lanes increasing by over 500 per cent. The change has largely been driven by global container shortages with congestion and delays at shipping ports at major shipping hubs like Singapore and China.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter