Fairfax looks set to reject the offer of private equity group TPG to purchase the major mastheads and its profitable property arm Domain, as shareholders wish to avoid separating the media empire’s most profitable pieces.

Fairfax will not issue a formal recommendation until adviser Macquarie has finished a detailed review of the TPG proposal later this week, however sources quoted within the 176-year-old publishing group say it is ’highly unlikely’ the demerger would be accepted in its current form.

Fairfax is under the pump with its legacy print business suffering ongoing financial struggles. It has just been revealed that Facebook and Google are now sucking up 40 per cent of the entire Australian advertising spend, a fair bit of that would have come to Fairfax in the past.

According to Fairfax, TPG Group has made an unsolicited approach that would see property listings business Domain sold to TPG along with the metropolitan publishing assets (including the Sydney Morning Herald, The Age and the Australian Financial Review) to form a new company the consortium is calling "Domain Co".

The offer is 95c cash per share, but shareholders say they do not want to be left with the less profitable parts of the empire.

Lee Mickelburough, head of Australian equities at Henderson Global Investors, which owns five per cent of Fairfax says, "It is an easy thanks but no thanks.

"It is a troublesome structure to say that we get 95 cents for the good business and you get to keep the debt for the transition businesses. It is cheeky, the way they have structured it."

Meanwhile staff are being cut across the mastheads, to take $30m off the books. This has led to a strike by Fairfax journalists, who have been enraged at the $2.5m bonus awarded to Greg Hywood while being asked to put themselves up for redundancies.

And adding to the tumult around Fairfax the Government is poised to remove the ‘two out of three’ and ‘reach’ media ownership laws, which prevent companies or individuals from owning radio stations, television networks and newspapers servicing the same audience, and from broadcasting to more than 75 per cent of the population at once.

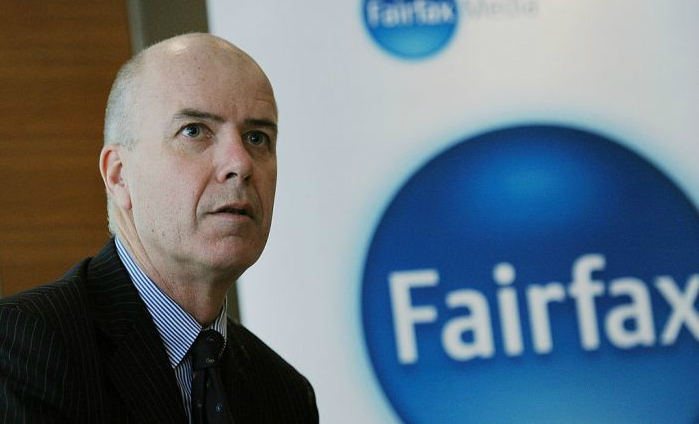

This will potentially open the door to mega-mergers, with the Australian media landscape heading towards more concentrated ownership. Fairfax is tipped to merge with Channels 9 or 10. Fairfax CEO Greg Hywood says the changes are ten years too late.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter

Fairfax also said “thanks but no thanks” to buying seek in 2003 and Realestate.com in 2000. It seems to me that the “thanks” keeps going to a poor performing board and the “no thanks” keeps getting dished out to shareholders!