Heidelberg says it is on track to meet its medium-term targets, with Group sales set to rise by 20 per cent to hit the €3bn marker with profit level of around €100m.

The press giant says its new subscription model for buying presses – available in Australia – where Heidelberg supplies the metal, the consumables and the servicing for a fixed monthly fee over five years, is proving a winner with more than 30 printers around the world signed up for €150m, a number it expects to rise significantly.

Heidleberg was battered by the GFC a decade ago and the subsequent global downturn in offset press orders, as market leader it suffered the most. However it has worked its way out of strife and into a position it says it will grow from, by focusing on digital opportunities and partnerships.

Rainer Hundsdörfer, chief executive officer at Heidelberg, says, “Heidelberg made excellent progress with its digital transformation in 2017/2018. Both our new subscription model and the new digital presses are in high demand. Given that this will be reflected in the company’s sales and result to an ever greater extent in the years ahead following the current start-up phase, our medium-term targets will be increasingly within our grasp,”

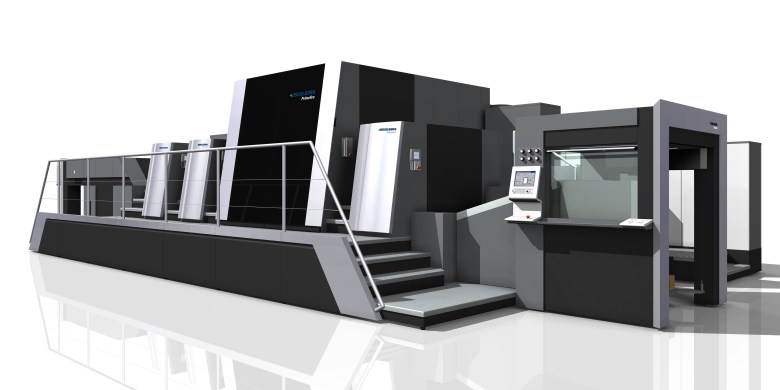

Heidelberg believes the series production of digital presses for packaging and label printing, the Primefire and Labelfire, will have an increasingly positive impact on sales so it sees itself on course to meet its medium-term targets, which include an increase in Group sales to around €3bn, an operating result (EBITDA) of €250 to €300m, and a net profit after taxes of over €100m.

Based on provisional figures that have yet to be audited, Heidelberg has achieved the targets it set itself with Group sales of €2,42m in the current year. It says the shortfall compared with the previous year’s figure of €2,524m comes mainly as a result of negative currency effects and the deliberate avoidance of trading activities in low-margin remarketed equipment amounting in total to over €100m.

Despite the negative currency effects in the period under review, incoming orders sat at an encouraging level for a post-drupa year at €2,588m (previous year: €2,593m). The demand in the final quarter of the year rose on the figure for the same quarter of the previous year, among other things due to the full order volume of subscription contracts being taken into account. This contributed to a significant increase in the order backlog at the end of the financial year.

The EBITDA margin of 7.1 per cent came within the expected range. Lower interest costs resulted in a further significant improvement in the financial result.

As expected, free cash flow was slightly negative at €-8m due to acquisitions and investments associated with the construction of the new innovation center in Wiesloch. The net financial debt fell to €236m in the reporting period.

Dirk Kaliebe, chief financial officer at Heidelberg, says, “Our growth initiatives are accompanied by a new financing framework that also enables us to further accelerate the digital transformation through targeted acquisitions.”

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter