It has taken six years, two chief executives, hundreds of millions of dollars, and the loss of multitudes of staff but it looks like the massive restructure of Australia’s biggest printer is finally over. PMP has returned three straight reported profits, small though they may be, and while more than $200m in revenue has been wiped out, it has made up for it with deep cuts to operational expenditure. In many ways PMP personifies the structural changes sweeping across the industry that printers must respond to or perish, and quickly. The message chief executive Peter George has is that PMP had too long lived in the good times before print was a shrinking industry, and had put its finger in too many pies. It was time to get back to basics.

“Print had it good but customers are not going to pay for our inefficiencies anymore,” George tells ProPrint. He says post-restructure PMP is a leaner, fitter, nimbler operation optimised for the modern print market, cutting off the many arms of its business that no longer work and focusing on areas it does effectively like books, catalogues, magazines, and distribution. George has not been afraid to cull what were previously core areas of PMP’s offering if they no longer fit its future vison. Gone is PMP’s unprofitable directories business after volumes collapsed by 72 per cent last financial year for a $50m revenue hit. George says the company is still printing a few local directories but will be completely out of the market by the end of the financial year.

Even in the areas PMP has left, the determination to pursue sustainable margin overides, with the company deciding not to re-sign low-margin catalogue contracts, which were worth five per cent of its volume. This led to further revenue falls in the first half of this financial year, but the company sees this as all part of the price of survival. As far as George is concerned this change is long overdue both at PMP and in the wider industry. “People are starting to change their businesses to be efficient and sustainable,” he says. “Some like Franklin Web led the way on improving and we were a bit slow.”

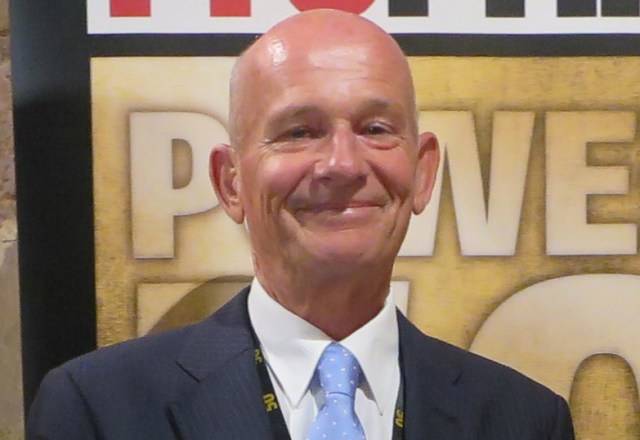

The extent of the print giant’s turnaround from embattled dinosaur to sustainable force has impressed many of its critics. Many printers have over many months told ProPrint that they thought PMP was headed for collapse after the disastrous losses of 2012 and 2013, when the wheels completely fell off the much-vaunted recovery plan of George’s predecessor Richard Allely. The enigmatic chief executive was even rewarded with the prestigious HR Award for Best Change Management in November 2011 after dragging the company back into what appeared to be a good position, and he finished atop the ProPrint Power 50.

It was but two months later that Allely downgraded earnings expectations by 24 per cent, lost the Pacific Magazines contract, and saw vultures began to circle once more. Print management business TMA came in with a cheeky $250m takeover bid, ultimately unsuccessful, and PMP lost almost $25m on the back of huge write-downs and redundancies as more restructuring proved necessary. Plans to slash its offset press fleet by a third was just one of the painful measures instigated despite Allely’s insistence restructuring was over. By October 2012 Allely was shown the door in favour of George when the board decided it would rather pay him almost $1m to go away rather than have him serve the one-year notice he gave when resigning the previous month. George was considered a turnaround artist better suited to fixing the company’s woes, with a long restructuring resume including Optus, Mayne Nickless, Nilex, Asciano and B Digital. He swore to turn the business around in 18 months – and so far it seems he has delivered.

The new plan was painful. The loss-making data business was sold off for $6.2m, the Canberra business was sold to Focus Press (we know how well that went), and it sold and leased back several of its plants in a series of deals worth $74m. Much like what the industry as a whole has to do, George says PMP is now rightsized and well positioned for future growth in a rapidly consolidating market. “PMP had a winning strategy under its nose but the structure never let us take advantage of it,” he says. “We can offer nationwide bundled printing and distribution solutions to our major customers, delivering the benefits of the co-location of our print and distribution services and realigned functional workforce. These strengths allow us to offer our customers a competitive, integrated service in a timely manner. Three years ago only one or two of our big customers were doing both print and distribution with us. Now seven out of fifteen are.” George says this is evidenced by $20m in recent contract wins that will start bearing fruit in the fourth quarter. He says 75 per cent are in heatset printing and 25 per cent are distribution.

The company’s fortunes have been further buoyed by a resurgent book market that is shifting to a print-on-demand approach, as this section of the business grew 26 per cent from new contract wins in the past half-year and has installed a new digital printer to handle short-run fast turnaround work. “The average size for a book run used to be about 100,000 but now are as low as 500,” he says. “We are seeing a trend towards more frequent but smaller orders, which is good for Australian printers because it means overseas suppliers are less competitive because of turnaround times.” George says there is ‘no doubt the age of digital is coming’, but the speed is not there yet – though worth monitoring closely as technology advances.

Not all the news is good as magazine print and distribution revenue both fell, but George says the end is in sight for heatset price falls, which have been in freefall for years. “Heatset continues to be challenged by structural factors such as excess industry capacity in Australia, although there are indications that this situation is gradually improving,” he says. “I think the worst is over and things will stabilise soon.” George is particularly bullish about the catalogue market, which fell slightly for a one per cent hit from lower pagination as retailers tighten their budgets in slow trading conditions. He is a ‘strong believer’ in the future of catalogues and says they are the best way to sell many different products. “Catalogues continue to be a critical element of retail marketing and we expect this core part of our business to strengthen in line with the retail sector as it has done through previous economic cycles,” he says. “Times are tough so retailers cut costs, so we must evolve with our customers and become more targeted to consumers.”

With the business slimmed down to a sustainable portfolio, millions in new contracts about to roll in, and optimism returning both inside the company and around the wider industry, Australia’s biggest printer may finally be looking at better times for real. George says he expects revenue, margin and profit to trend upwards into the future instead of going backwards as they have been for years. But don’t pop the champagne just yet, lest the rude awakening of 2012 repeat itself. If this saga has taught us anything, it is that things can change alarmingly quickly, both for better or worse.

Background briefing

- February 2012: The wheels fall off Allely’s transformation plan as PMP downgrades earning by 24 per cent, loses the Pacific Magazines contract, and cuts 60 jobs.

- April 2012: Vultures circle as printer downgrades earnings by 30 per cent – TMA makes $250m bid for PMP.

- August 2012: PMP loses $24.5m and plans to cut press fleet by a third despite earlier promises restructuring was over

- September 2012: Allely resigns with one year notice.

- October 2012: Board pays Allely pushing $1m to go away, installs Peter George as CEO.

- Nov 2012-Jan 2013: George promises to turn PMP around in 18 months, guts 120 jobs shutting the Chullora plant, and sells loss-making data business for $6.2m.

- Feb 2013-Mar 2014: PMP sells and leases back several of its plants in a series of deals worth $74m.

- August 2013: PMP sells Canberra business to Focus Press and cuts debt 37 per cent.

- February 2014: PMP gets back in black with small half-year profit, stays in profit for full year in August.

- February 2015: Maintains profit for half year, George says restructure finally over.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter