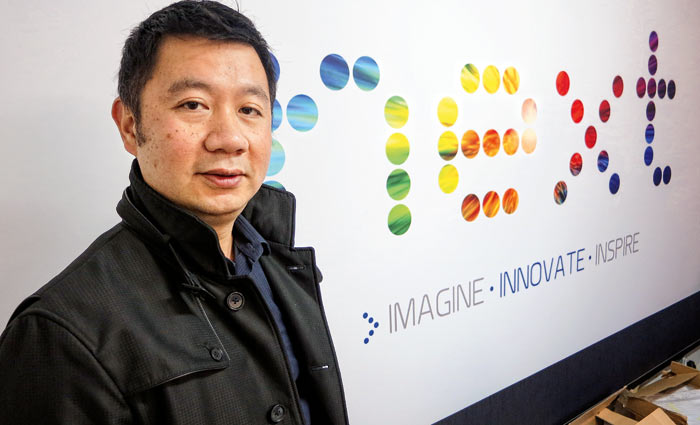

What do you do if your market is shrinking and you can see the day when fewer people will want your product? If you’re Next Printing boss Tom Tjanaria, you don’t diversify out of print: you diversify into it.

The Sydney large-format firm was born from Photo King, a one-hour photo retailer founded in 1986. Photo King’s proudest moment came in 2000 when it was appointed the official photo developer for the Sydney Olympics’ media centre – but ironically it was also the year in which Tjanaria noticed the irreversible decline in photo printing. That ultimately convinced him to invest $1 million to establish Next Printing in 2004.

[Photos: Behind-the-scenes at Next Printing]

Managing director Tjanaria has a pragmatic view of Next Printing’s current position: profitable today, but potentially vulnerable to any sudden market shifts that may occur tomorrow. Next Printing faces a similar challenge to Photo King; it has to be farsighted enough to see where the market is heading and flexible enough to make fundamental changes to its business model.

Photo King originally brought Tjanaria together with Next’s general manager Romeo Sanuri. The two Indonesians have known each other for more than 20 years. Sanuri began working part-time at Photo King in 1991 after coming to Australia to study computer engineering. He returned home in 1996, but moved back to Sydney in 2003 to help launch Next.

Quality was one of the hurdles Next faced when it opened its doors, says Tjanaria. “When we first started, we couldn’t accept the quality because we were coming from a very high end-quality point.”

Eventually, he and Sanuri learned that Next clients had different expectations from Photo King’s customer base. People look at large-format prints from a distance, so they don’t need to have the same resolution as photographs that are examined from close-up.

In other words, photography and large-format are completely different markets. This meant it was a challenge for Next to build a client base from scratch. The company also had to do its homework on substrates, because large-format operators print on a broader and more technically diverse range of materials.

Next started with two staff: Sanuri and a printer. In those early days, Sanuri worked across production, pre-press and finishing – and even swept the floor. He says it was an excellent learning experience, though a difficult one, and that it took about a year for him to master his sales and production roles.

Photo King is still in the Tjanaria family, though it is fair to say Next Printing has been the major focus over the past decade. Tjanaria won’t disclose revenue figures, but does reveal that the large-format print company has averaged 25% growth since 2005. He adds that Next Printing grew 15% in 2012-13 and is forecast to expand by another 15% this financial year.

The numbers sound impressive, but the market is changing rapidly so there’s no time for complacency. Tjanaria notes that the selling price for vinyl has fallen by 40-80% since Next opened its doors. The lesson is that the company must constantly keep its eyes open for emerging sectors with less competition and higher margins.

That was the logic behind the November 2011 move into fabrics, a challenging form of printing with high barriers to entry. Next didn’t have the technical skill in-house, so it hired an experienced fabrics operator, Julian Lowe, to oversee the division. The new offering was pitched to clients in June 2012, says Lowe.

“It took us about six months of research to get it right. There are still new things we’re learning because fabric is a unique material,” he says. “Traditionally, printing on fabric hasn’t had a good colour gamut. It’s always been something that has scared a lot of people off.”

Lowe says the variables associated with fabrics are “insanely huge”. Stock differs from batch to batch. The substrate’s structure changes during the production process, and in inconsistent ways. There are even problems after installation, because fabrics can contract and expand depending on the weather.

Fabrics are now a rapidly growing sector for Next – and samples aren’t hard to find. Its fabric backdrops can be seen on The Voice, Masterchef and The Biggest Loser. Next also produced backdrops for the Sydney launches of World War Z, Star Trek into Darkness and Monsters University.

Tjanaria says Next first considered branching into fabrics in about 2006, but decided to hold off because it felt Australian clients weren’t ready to embrace something so different. Now they are a lot more receptive to the idea.

Environmental concerns are part of this. Next prints direct to fabric, as opposed to the traditional and less efficient method of printing on paper and then transferring. Lowe says vinyl has a bad environmental reputation and is being phased out in Europe. Fabrics are seen as a green alternative.

He says fabrics offer other advantages over vinyl: they’re much easier to install, because they’re lighter, and also have a more graceful aesthetic. However, he concedes that vinyl still offers greater durability and that its solid surface allows for higher-quality printing. But technology is rapidly eating away at those advantages, he adds. “Where fabric can replace vinyl, it has. Where fabric can’t substitute, it hasn’t yet done so.”

One thing fabrics have in common with other sectors is demand for ever-faster turnarounds. Sanuri, says the company’s speed is market leading. The industry standard is 10 working days; Next is more than twice as quick, he says.

Sanuri echoes Tjanaria when he says that good results today don’t guarantee success tomorrow. Next is looking to technology to help reduce turnarounds for fabric jobs and remain competitive. Sanuri says Next has an impressive production capacity, with two direct-to-fabric printers and one UV printer than can also do fabrics.

However, productivity drops when the work moves to finishing. “We’re investing in equipment that will help us make the process faster because there is still a lot of manual work. We want to automate those processes.”

The company invested $300,000 in 3.2m-wide Océ ProCut 1600 fabric cutter, which is due to arrive at the end of July.

Tjanaria adds: “It’s important to have the latest technology. That will help us to cut down labour, which allows us to cut down the costs and helps minimise mistakes. Also, the quality is better with the latest technology and helps us provide a better product.”

Switching things up

Next made pre-press more productive with the implementation of SwitchBox in January. The customised workflow system was supplied by Soltect, the new name for Colourprocess. SwitchBox has automated about 70% of Next’s pre-press functions, says Sanuri. Mundane tasks that used to take minutes can be done in seconds.

“The improvement is 10 to 20 times faster on average. We’re able to process files faster, which improves our turnarounds. Now we can email proofs back to clients within an hour, or even quicker.”

Next’s other software products include Caldera for colour management and Blaq for cloud-based job fulfilment manage-ment. The factory floor has an all-digital line-up, which includes two Durst Rho P10 250 flatbeds, an HP Scitex FB7600 flatbed, Durst Rho 351R roll-to-roll printer, Durst Rho 320R roll-to-roll printer, Durst Lambada 130 photographic roll-to-roll printer, Durst Theta 76 photographic roll-to-sheet printer, Fuji Xerox 700 Digital Color Press and Esko Kongsberg XP24 cutter. Sanuri says the life cycle of machinery at Next is usually three years.

It’s all part of a strategy to regularly upgrade and automate so that more work can be done by fewer staff, says Tjanaria. He doesn’t want the current headcount of 46 to grow by much – if anything, he hopes it slightly falls.

He says Next has a proud record when it comes to investing in technology. The company started with a Vutek flatbed; the idea was to have a point of difference, because the flatbed printed directly to board and, therefore, produced faster turnarounds. Next also thought big – literally – with its second production printer, a five metre-wide HP Scitex that it installed in 2006. “We’ve bought a new machine every year since.”

The company’s next investment may be in real estate. Next currently has 1,500sqm of space, spread over three adjacent units on an industrial site in St Peters. The first unit was acquired in 2004, the second in 2008 and the third in 2010 – and now Next is negotiating to buy a fourth. The new unit is on the same block, although not connected to the others. Despite the inconvenience, Tjanaria says Next is unwilling to surrender its strategic location by moving. The premises is 7.5km from the CBD and is also close to major freeways, freight forwarders and suppliers, which makes transportation easier and allows Next to respond rapidly to last-minute changes in jobs.

Those jobs are 45% retail, 35% exhibition and events, 15% signage and 5% other. Clients include Fremantle Media, Shine Australia, Jigsaw, David Lawrence, Marcs, Saba and the Sydney Cricket Ground, says Sanuri.

“Our involvement in high-end photographic has also won us contracts with production houses for cosmetic and fragrances companies such as Chanel, Estée Lauder, Lancôme, Christian Dior and L’Oréal to name a few.”

Branching out

When Sanuri talks about a photographic partner, he is referring to Photo King, which has reinvented itself as a niche supplier of large-scale prints, mainly to artists. Photo King started as a one-hour photo retailer, but then branched out into trade work for about 50 other businesses because it was one of the few labs that could print up to A3, says Tjanaria. “That was large-format back then,” he jokes.

Next sometimes outsources work to Photo King; Next’s inkjet machines can only print at 1,800dpi, whereas Photo King’s can reach 4,000dpi.

Sanuri says he relishes difficult jobs – because they’re the most profitable, despite their shorter run lengths. “We try to get high-margin jobs rather than big volumes and low margin. We need to be very careful, because nowadays jobs come in differently to two or three years ago when you could predict every month what your revenue and volumes would be.

“Now it’s become very sporadic. Also, clients are more willing to shop around and look at other providers. Overall, we’re growing year by year, but we have to be aware of the changes in the market. At Next Printing, we try to identify niche areas our competitors haven’t entered, because if everyone is doing the same thing, there’s no benefit, because we’ll be fighting against each other and having a price war.

“In 2011, we looked at fabrics, because the barriers to entry are very high. That was about being able to provide another niche offering… It’s about trying to provide a wider offering to our clients,” he adds.

Another niche offering is re-board, a patented rigid paperboard that is about one-fifth lighter than medium-density fibreboard for retail displays. Next’s first installation was a Nestlé Club display for Woolworths and Coles in September 2012. That same month, Next promoted its new offering by erecting a 6.1-metre re-board model of Sydney Tower at the POPAI retail expo. Sanuri told ProPrint at the time that it was the world’s tallest re-board structure, ahead of a six-metre high castle.

New products, new machines, new premises – it suggests a company in constant evolution. Sanuri says that a willingness to change has always been one of the keys to Next’s success and is essential to the company’s future prosperity.

“The challenge is not being afraid of doing something new. Whenever there are changes, there is always a lot of resistance. Internally, we have to improve the way we do things and get used to new processes. Externally, we have to explain the new solutions to clients. Some clients react positively, but others think they may be too risky. We’ve found clients that are early adopters benefit, because it makes them unique from other retailers. The point is to help our clients be successful, which translates back to our success.”

Factfile

Established 2004

Sector Large-format

Staff 46

Based St Peters, Sydney

Floor space 1,500m2

2012-13 growth 15%

2013-14 forecast 15%

Business briefing

· Next Printing managing director Tom Tjanaria invested $1 million to establish the company in 2004

· Next prints for all five free-to-air TV stations. Its work has appeared on Masterchef, The Voice, The Biggest Loser, Beauty & the Geek, The Apprentice, X-Factor, Q&A and The Gruen Transfer

· Clients include Fremantle Media, Shine Australia, Jigsaw, David Lawrence, Marcs, Saba and the Sydney Cricket Ground

· The company targets niche areas with less competition and higher margins, which is why it moved into fabrics in 2011 and re-board in 2012

· The firm’s turnover is 45% retail, 35% exhibition and events, 15% signage and 5% other

· Next has an all-digital line-up and has bought at least one machine a year since 2006

· It owns three units in the same industrial site and is in negotiations to buy a fourth

· Next’s two key executives, MD Tom Tjanaria and GM Romeo Sanuri, were born in Indonesia

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter