GCG gross profits were up 11% from US$189m (A$211.9m) to US$210m (A$235.5m) in the three month to 31 December 2009. Kodak GCG operating earnings were up US$40m year on year to US$36m from a US$4m loss last year.

Overall, Kodak recorded a profit of US$430m on sales of US$2.58bn, up 45% from the last quarter and up 6% year-on-year, prompting a 19% surge in the company’s share price. Full-year revenues were down 19% from US$9.41bn in 2008 to US$7.6bn in 2009.

The 5% fall in GCG sales from US$821m in Q4 2008 to US$779m in Q4 2009 was mirrored by a 5% decline in ‘Prepress Solutions’.

According to the company: “Net sales of ‘Prepress Solutions’ decreased 5% for the quarter, primarily driven by volume declines and unfavourable price/mix of output devices, analogue plates and other pre-press equipment.

“The volume and price/mix performance is a reflection of the decline in worldwide print demand, which reduced demand for pre-press equipment,” it said.

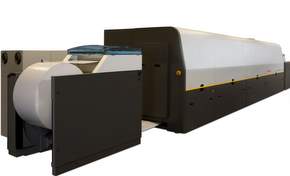

Sales of digital printers were less hard hit, falling just 1% year-on-year. Kodak said that falling volumes of toner-based devices were offset by increases in commercial inkjet.

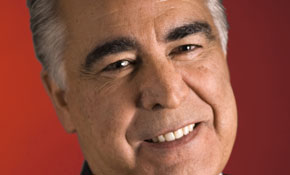

Kodak chief executive Antonio Perez said: “In the fourth quarter, we grew sales of commercial inkjet products, including a 33% increase in sales of our VL2000 printing system and enjoyed continued strong customer orders for our Prosper product line.”

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter