Kodak, which triggered concerns about its financial viability when it recently drew down a $160m credit line to fund ongoing operations, ended the quarter with $862m in cash and equivalents, down nearly $100m from the end of Q2.

The top line revenue missed the expectations of most analysts, who projected about $1.65bn in sales for the three months. However, the year-over-year quarterly comparisons were impacted by $210m in patent-related revenue in Q3 2010 that wasn’t on the books this year.

Kodak also offered few additional details on the planned sale of approximately 1,100 US digital imaging patents, which represent about 10% of the company’s patent portfolio and which are not core to its future, though it did note it expects the proceeds to materially increase its cash balance.

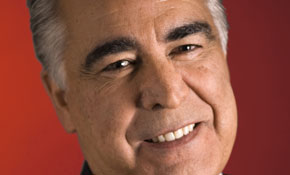

Outside estimates put the value of those patents at as high as $3bn. In a conference call with analysts, chief executive Antonio Perez noted: “Even though our patents are not wireless patents, they are a fundamental part of the wireless ecosystem. They’re very valuable and we expect to get fair value for our shareholders from them.”

Commercial printing is emerging as one of Kodak’s more promising plays. The company touted some Q3 success in its Consumer and Commercial Inkjet, Workflow Software & Services and Packaging Solutions divisions, which saw revenues increase 13%, fueled by 44% revenue growth in Consumer Inkjet printers and ink, and 89% revenue growth in Packaging Solutions.

“In Consumer Inkjet, ink gross profit dollars doubled in the third quarter and year-to-date,” said Perez in a statement.

“Our installed base of printers is now sufficiently large that we expect to meet a key milestone in the fourth quarter – achieving positive gross profit for this business as a whole, driven by ink gross profit. Packaging Solutions sales increased 89% in the quarter and more than 130% year-to-date”

During the conference call, Perez would not disclose the number of Prosper digital print heads sold, but noted Kodak had “many hundreds of sales.”

“Let’s say 1,000 heads are out there working perfectly and there are many more to come.

“There are a lot of customers that have offset presses that are good customers for our digital plates, but they’re not ready to move to full digital and they won’t be for years,” he continued. “But they find this hybrid system fantastic and it’s fantastic for us because we sell the heads, and we sell the ink and we sell the service that is associated with it.”

Perez added revenue for the digital Prosper press product line rose 40% in Q3, though he would not give exact sales numbers. He told the analysts that a lot of the growth will come from the Asia Pacific region. “Many of the institutions in Europe and the US will do hybrid first as they try to utilise the assets that they have because their volumes are soft.

“I am disappointed with the results of our legacy commercial inkjet because we wished the new products had happened a little earlier. But I’m very pleased with Prosper because 40% growth in a market like this is extraordinary.”

This article originally appeared at printweek.com

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter